Vancouver homeseller boasts of making $92,500 from Airbnb last year

By ThinkPol Staff

A Vancouver home where the seller boasted of making $92,500 from Airbnb last year has sold for the asking price.

“Owner on main, top and bottom run as AIRBNB $92,500 in 2017. Can be purchased with AIRBNB furnishings.” the MLS listing for the property on the 1000 block of E 12TH Avenue read before it was taken down following the sale[1]https://webcache.googleusercontent.com/search?q=cache:UY4s8p3MO8cJ:https://www.remax.ca/bc/vancouver-real-estate/na-1627-e-12th-avenue-na-wp_id206366272-lst/+&cd=8&hl=en&ct=clnk&gl=ca.

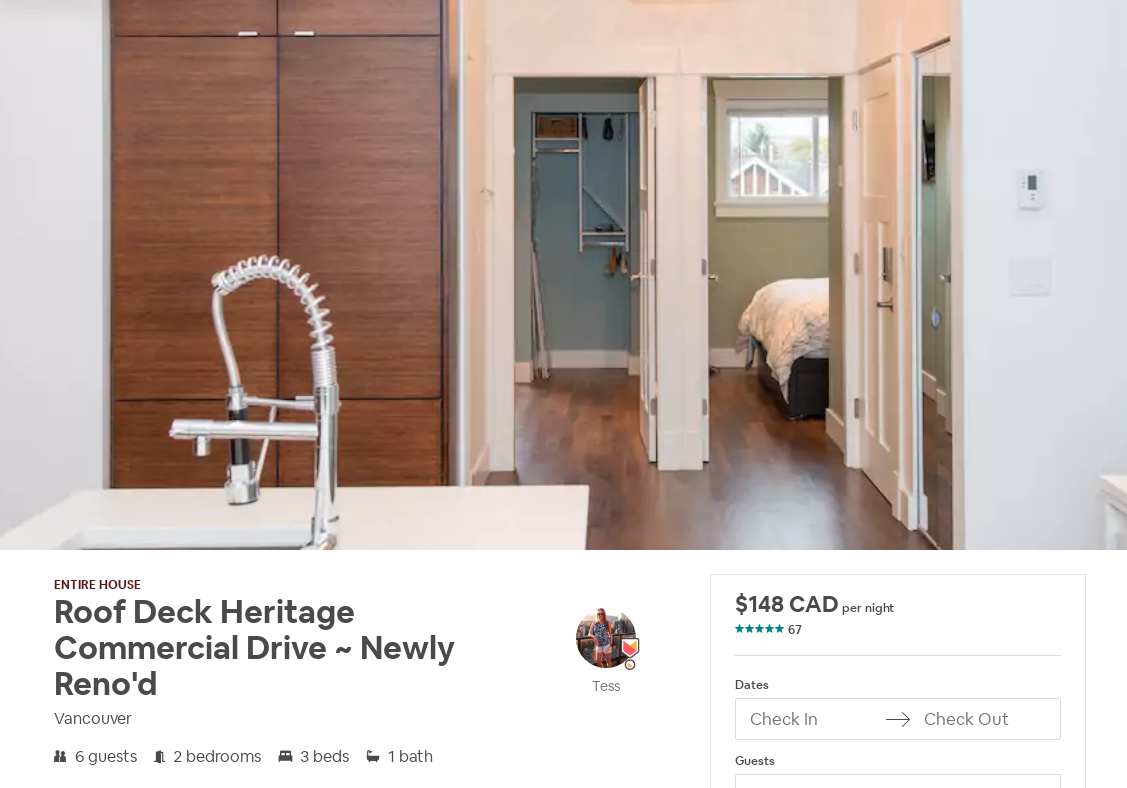

The top unit is still listed as “Roof Deck Heritage Commercial Drive ~ Newly Reno’d” on Airbnb[2]Original: https://www.airbnb.ca/rooms/4008123 Archive: http://archive.is/ynSQD at the rate of $148 CAD per night.

The bottom unit is advertised as “Spa Bath! Character Home ~ New Reno” for $99 CAD per night [3]Original: https://www.airbnb.ca/rooms/4161636 Archive:http://archive.is/1ISXG.

The seller is a “superhost” who goes by the name of “Tess” on Airbnb[4]Original: https://www.airbnb.ca/users/show/20782943 Archive:http://archive.is/x3ojb.

Tess describes herself as 35-year-old working for a union in Labour Relations advocating for members’ rights with a background in Human Resources.

The listing agent is named as Paul Eviston from RE/MAX Select Properties.

The MLS listing details sent to ThinkPol by the industry insider who first brought this sale to our attention shows that the property was sold for the asking price of nearly $1.7 million – well above the assessed value of $1.4 million – after being on the market for just nine days.

“The listing realtor should not be advertising illegal activities on MLS listings,” the industry insider who did not wish to be identified said. “But the fact he’s doing it without any fear is a clear indication that neither the City of Vancouver nor Real Estate Council of BC is interested in enforcing any laws that hurt Airbnb profits.”

Under the bylaws in place in Vancouver in 2017, homeowners were not allowed to offer entire units as short term rentals. Even under the new laws that came into force on April 19, secondary suits and multiple unit rentals by a single host is prohibited[5]http://vancouver.ca/doing-business/short-term-rentals.aspx.

“I have done my part and reported the homeowner to the CRA,” industry insider said. “She should not be claiming the principal residence exemption on the capital gains from this sale.”

References

| 1. | ↑ | https://webcache.googleusercontent.com/search?q=cache:UY4s8p3MO8cJ:https://www.remax.ca/bc/vancouver-real-estate/na-1627-e-12th-avenue-na-wp_id206366272-lst/+&cd=8&hl=en&ct=clnk&gl=ca |

| 2. | ↑ | Original: https://www.airbnb.ca/rooms/4008123 Archive: http://archive.is/ynSQD |

| 3. | ↑ | Original: https://www.airbnb.ca/rooms/4161636 Archive:http://archive.is/1ISXG |

| 4. | ↑ | Original: https://www.airbnb.ca/users/show/20782943 Archive:http://archive.is/x3ojb |

| 5. | ↑ | http://vancouver.ca/doing-business/short-term-rentals.aspx |