BC Liberals unhappy that speculation tax targets British Columbia’s 1% wealthy enough to own multiple homes

By ThinkPol Staff

The BC Liberals are criticizing the speculation tax recently introduced by the province’s Green-backed NDP government because it affects the one percent of British Columbians wealthy enough to own two or more homes.

“I think the minister is missing the point of our discussion here by saying that 99 percent of British Columbians are not going to be affected by the speculation tax,” BC Liberal MLA Shirley Bond said during the budget debate on Wednesday. “Of course they’re not, because this is about speculation. I would assume the minister would at least agree with us that when the average person thinks about who a speculator is, it is not British Columbians who have worked hard and have purchased a second home.”

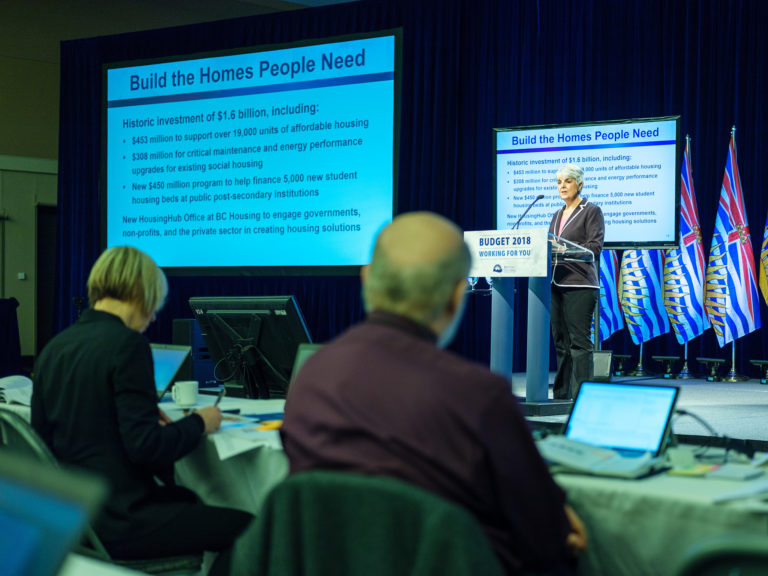

Finance Minister Carole James had earlier explained that there were 20,000 B.C.-owned homes and 12,000 non-B.C.-owned vacant homes.

“I think it’s important, again, to note the numbers and to note the facts, which are that 99 percent of British Columbians will not pay the speculation tax,” she said. “That’s a fact. That is a fact. Two million homes, and 1 percent gives you the numbers we see. So 99 percent of British Columbians will not pay the speculation tax.”

That did little to convince the BC Liberals, with opposition finance critic Tracy Redies saying that the speculation tax “is disproportionately impacting British Columbians who own second homes in this province.”

The finance minister stood her ground.

“There are 1 percent of British Columbians who own multiple properties in these particular areas — I’ve given the numbers — and they have the opportunity, as individuals who have benefited from the increasing housing market and who have benefited by leaving it empty, to rent it out,” she countered. “They have an opportunity to pay a lower tax rate than others are paying — a quarter of the rate. They have a $400,000 exemption, as well, that they have an opportunity to address. The largest amount of revenue coming in is coming in from non-British Columbians.”