Wealthy Vancouver homeowner likens BC NDP housing reforms to Nazi race laws

By ThinkPol Staff

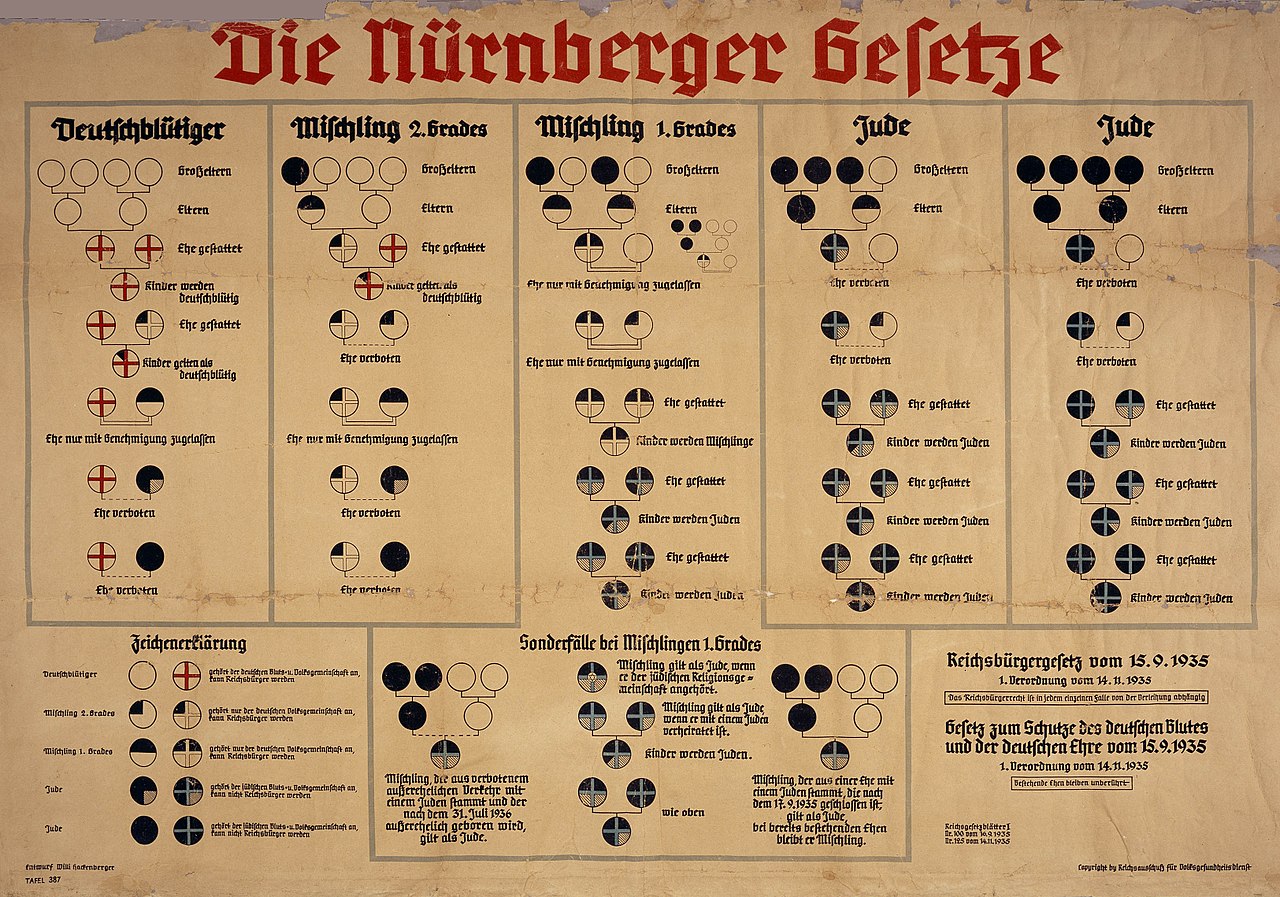

A homeowner from Vancouver wealthiest neighbourhood is likening British Columbia NDP government’s reforms at tackling the region’s housing crisis to Nazi race laws.

“Don’t be misled,” Robert Angus is quoted in Shaughnessy Heights Property Owners’ Association newsletter[1]Original:http://www.shpoa.ca/shaughnessy_voices Archive:http://archive.is/PWcgf. “These taxes and restrictions are founded on envy and racism. They have nothing to do with building a better society, any more than the race laws in Nazi Germany were designed to bring about a better society.”

“We have been hit with the Foreign Purchaser’s tax, which by the way, comes out of the seller’s pocket, not the buyer’s,” the newsletter quotes Angus, even though the government has made it clear that the buyer, not the seller, pays the tax[2]https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax.

“We have all been hit with the increase in the property transfer tax, which also comes out of the seller’s pocket, not the buyer’s,” Angus is quoted as saying. “And now we are getting hit with this misnamed School Tax Increase.”

Other Shaughnessy residents are claiming that the NDP is waging war against wealthy British Columbians.

“Basically, these taxes are all “wealth taxes” directly attacking people that have been able to accumulate assets over time using after-tax dollars,” the newsletter quotes personal injury lawyer Wes Mussio. “These measures will do nothing to improving housing supply. In the result, it’s really a taxation assault on the more well-off people in British Colombia[sic].”

Meanwhile, BC’s Attorney General David Eby, who has borne the brunt of the wealthy homeowners’ anger over the housing reforms, has explained in a blog post that even with the school tax, Vancouver homeowners will end up paying significantly lower property taxes than their counterparts in other major cities in Canada[3]http://davidebymla.ca/news/the-school-tax-increase-on-homes-valued-over-3m-some-factual-information/.

For example, an owner of a four million dollar home in Vancouver, even with the school taxes, would be paying a less than third of what a homeowner in Ottawa or Montreal will pay, and less than half of the property taxes levied in Calgary or Toronto.

| 2017 | Calgary | Montreal | Ottawa | Toronto | Vancouver pre-tax | Vancouver estimated post tax | UEL pre-tax |

UEL estimated post Tax

|

| $2M home | $13,000.00 | $19,760.00 | $21,360.00 | $13,240.00 | $5,100.00 | $5,100.00 | $4,340.00 | $4,340.00 |

| $4M home | $26,000.00 | $39,520.00 | $42,720.00 | $26,480.00 | $10,200.00 | $12,200.00 | $8,680.00 | $10,680.00 |

| $5M home | $32,500.00 | $49,400.00 | $53,400.00 | $33,100.00 | $12,750.00 | $18,750.00 | $10,850.00 | $16,850.00 |

| $8M home | $52,000.00 | $79,040.00 | $85,440.00 | $52,960.00 | $20,400.00 | $38,400.00 | $17,360.00 | $35,360.00 |

| $10M home | $65,000.00 | $98,800.00 | $106,800.00 | $66,200.00 | $25,500.00 | $51,500.00 | $21,700.00 | $47,700.00 |

Eby also made it clear that seniors and parents of young children are able to defer these taxes under very favourable terms.

“BC Property owners who are disabled, over 55, or with children under 18 years old can defer taxes in a program that has been available since 1974,” Eby said. “It is a program that offers extremely low fees, very favorable rates, and simple rather than compound interest. In fact it has been criticized for being non-means tested and actually being too favourable in its terms. Seniors who want to stay in their houses and defer taxes are welcome to do so, and many are already using this program.”

The Attorney General was planning to explain this to homeowners at a town hall meeting last week, but had to cancel the even over security concerns after the BC Liberal leader and the Leader of the Official Opposition Andrew Wilkinson urged his supporters to crash Eby’s meeting[4]http://davidebymla.ca/news/may-1-forum-and-community-office-cancelled-and-closed-due-to-safety-concerns-please-read-davids-letter-below/.

References

| 1. | ↑ | Original:http://www.shpoa.ca/shaughnessy_voices Archive:http://archive.is/PWcgf |

| 2. | ↑ | https://www2.gov.bc.ca/gov/content/taxes/property-taxes/property-transfer-tax |

| 3. | ↑ | http://davidebymla.ca/news/the-school-tax-increase-on-homes-valued-over-3m-some-factual-information/ |

| 4. | ↑ | http://davidebymla.ca/news/may-1-forum-and-community-office-cancelled-and-closed-due-to-safety-concerns-please-read-davids-letter-below/ |