“Scrap the Speculation Tax” coalition turns to big tobacco and asbestos PR firm

By ThinkPol Staff

The umbrella group campaigning to repeal the Speculation Tax introduced by British Columbia’s NDP government has enlisted the help of a controversial global public relations firm that gained notoriety for promoting big tobacco and asbestos industry interests.

The group behind the Stop BC’s Speculation Tax petition[1]https://www.change.org/p/british-columbia-government-stop-bc-s-speculation-tax joined forces with chambers of commerce, industry groups representing tourism and construction, and development industry lobbyists to launch Scrap the Speculation Tax campaign[re]http://scrapthespeculationtax.ca[/ref].

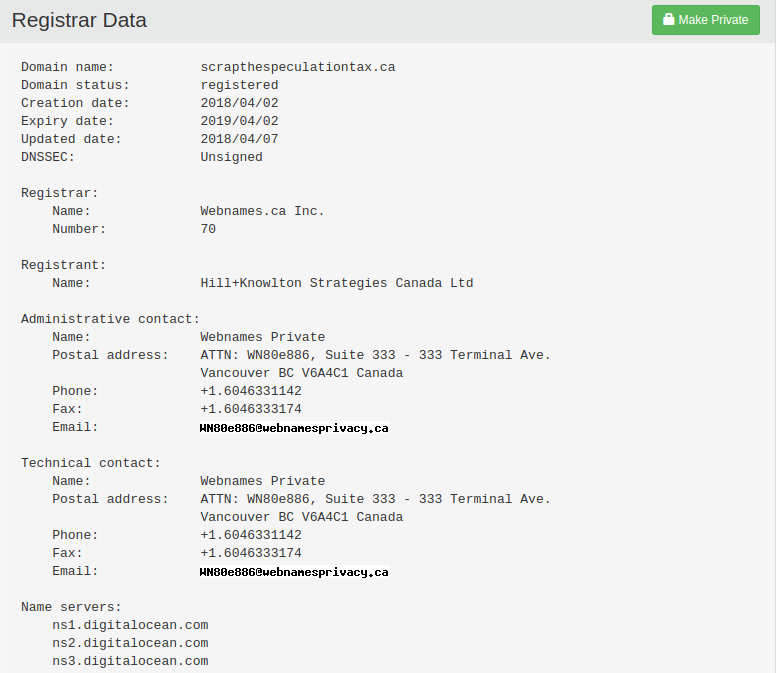

The domain name registration for the group’s website scrapthespeculationtax.ca shows Hill+Knowlton Strategies as the domain registrant[2]https://who.is/whois/scrapthespeculationtax.ca.

Hill+Knowlton Strategies became infamous for running campaigns to promote the interests of the tobacco industry[3]https://www.alternet.org/story/50359/how_a_pr_firm_helped_establish_america%27s_cigarette_century and asbestos industry[4]https://cprlaw.com/wp-content/uploads/2016/02/AIA-Article-AJPH.pdf among many other controversial clients.

Interestingly, BC Liberal leader Andrew Wilkinson, who’s a strident critic of the Speculation Tax[5]http://www.cbc.ca/news/canada/british-columbia/speculation-tax-kelowna-forum-1.4588539, has acted for multinational tobacco companies against the BC government, as the province sought to recover billions of dollars spent out of the public health-care budget to treat people with smoking-related diseases such as emphysema and lung cancer[6]https://thinkpol.ca/2018/02/05/bc-liberal-leader-batted-big-tobacco-bc/.

An Insights West poll[7] found that more than four-in-five (81%) British Columbians believe support the speculation tax targeting vacant homes whose homeowners pay no income tax in BC[7]https://insightswest.com/news/british-columbians-welcome-budget-proposals-on-real-estate/.

The tax rate is set at 0.5% of the property’s assessed value for this year, but will rise to 2% next year for foreign nationals and satellite families and 1% for Canadians who don’t reside in British Columbia[8]https://www2.gov.bc.ca/assets/gov/taxes/property-taxes/publications/is-2018-001-speculation-tax.pdf.

References

| 1. | ↑ | https://www.change.org/p/british-columbia-government-stop-bc-s-speculation-tax |

| 2. | ↑ | https://who.is/whois/scrapthespeculationtax.ca |

| 3. | ↑ | https://www.alternet.org/story/50359/how_a_pr_firm_helped_establish_america%27s_cigarette_century |

| 4. | ↑ | https://cprlaw.com/wp-content/uploads/2016/02/AIA-Article-AJPH.pdf |

| 5. | ↑ | http://www.cbc.ca/news/canada/british-columbia/speculation-tax-kelowna-forum-1.4588539 |

| 6. | ↑ | https://thinkpol.ca/2018/02/05/bc-liberal-leader-batted-big-tobacco-bc/ |

| 7. | ↑ | https://insightswest.com/news/british-columbians-welcome-budget-proposals-on-real-estate/ |

| 8. | ↑ | https://www2.gov.bc.ca/assets/gov/taxes/property-taxes/publications/is-2018-001-speculation-tax.pdf |