BC exempts vacation homes from speculation tax

By Drew Penner

The bureaucrats have done their tinkering and the new-and-improved levy on people taking advantage of hot West Coast real estate has been unfurled.

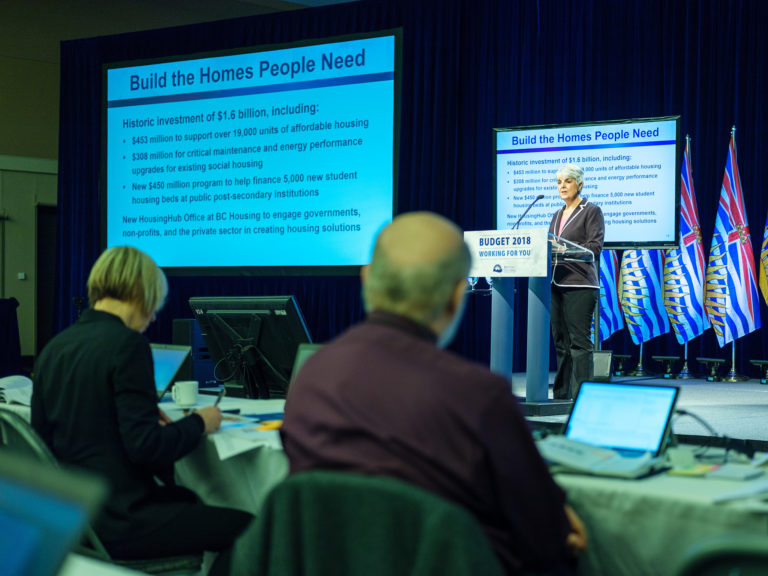

BC Finance Minister Carole James said despite revising speculation tax rules to exclude a number of properties and regions, the province still aims to haul in $200 million a year from the measure meant to free up rental supply for British Columbians.

“We’ve adjusted the amount of tax for the various level of speculation,” she said during a March 26 conference call with reporters. “Our goal is that people who work and contribute to our communities can afford to live here.”

Ever since the speculation tax was announced in its February budget, realtors, politicians and homeless alike have been eagerly awaiting details of the minority NDP’s stab at helping make it easier for BC residents to find a place to call home.

The government says it’s trying to target areas most affected by the housing crisis with the measure.

They’ve decided to exclude the majority of islands, rural areas and resort communities, with the idea that locals shouldn’t have to pay tax on a reasonably-sized second property they use for vacations.

“Vacation homes and cabins are not impacted,” James said. “Over 99% of British Columbians will not pay the tax.”

In fact, cottages and other second properties worth $400,000 or less will be fully exempt, with a non-refundable credit offsetting the first $400,000 of more expensive properties.

Vacant homes will face a 0.5% property tax starting in 2018.

Canadians who don’t reside in B.C. will have to pay a 0.5% tax on property here in 2018, rising to 1% the following year.

Investors and satellite families will initially be treated equally, having to pay the 0.5% tax on empty homes in 2018. But that will rise to 2% in 2019.

Properties with long-term tenants will also be exempt from the tax. So as long as the unit is rented six months out of the year in stretches of at least 30 days, landlords won’t have to pony up for the province.

“People have the option of leaving the house vacant and paying the speculation tax,” James noted, adding she expects the $7 billion the province is spending on building housing will assist with the affordability problem, too. “We recognize that it’s not simply a crisis for people that are homeless.”

Beyond modular housing options, which were first out of the gate, that will mean housing geared towards families, seniors, and students, as well as women and children affected by violence, she said.

While Kelowna and Victoria will be subject to the tax, James said Whistler wasn’t included, since it’s a resort municipality and can be targeted with tweaks to the hotel tax.

The BC Greens, who are propping up the NDP minority government, welcomed today’s announcement.

“It’s a positive sign that this government is willing to listen to British Columbians and to make adjustments to policies,” party leader Andrew Weaver said. “In a minority government, we have an opportunity to do things differently by collaborating to improve public policy. We worked hard to champion British Columbians’ concerns and bring forth evidence-based solutions to this policy’s shortcomings. We agree with the B.C. NDP that we need to take action to address speculation in our real estate market. However, we have been clear that we needed to see changes to this tax in order to support the forthcoming legislation. In particular, the government’s policy must target speculation and empty homes in our urban centres without undue adverse effects on rural areas and on British Columbians who aren’t speculators.”

The opposition BC Liberals accused the NDP government of governing by “trial and error”.

“Today’s announcement of changes to the speculation tax is just another example of the BC NDP making up half-baked tax policy on the fly,” Leader of the Official Opposition Andrew Wilkinson said. “In just over a month since their first budget, the NDP are already having to reverse one of their major tax announcements. Even more concerning is the lack of detail on what the lower revenue projections will be as the government tries to fix this blunder.”

[Photo Credit: Government of British Columbia]