Asking home prices fall by double digits in Metro Vancouver as BC budget begins to bite

By ThinkPol Staff

Asking prices for homes in Metro Vancouver are falling ‒ in one case by as much as 73% ‒ suggesting that budget measures announced by the NDP government to promote affordable housing by tackling rampant crime, corruption and speculation in the real estate market is beginning to work even before they come into force.

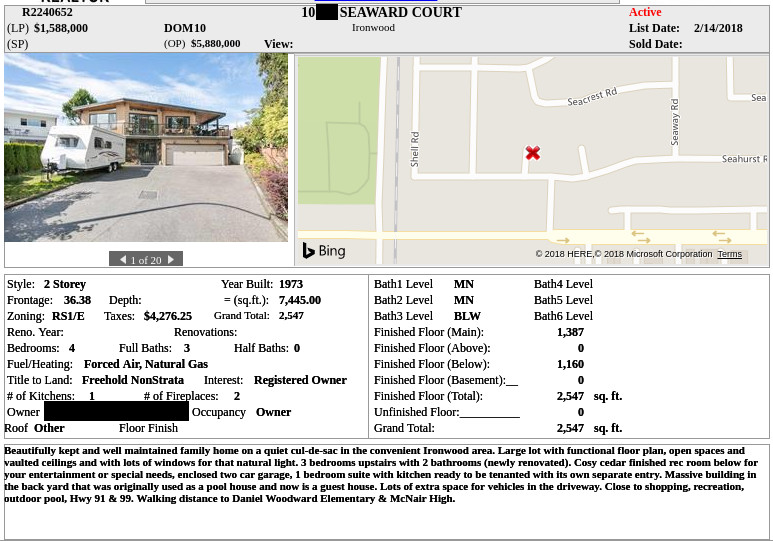

For example, the asking price for a home on the 10000 block of Seaword Court in Richmond’s Ironwood neighbourhood has dropped from the original listing price of $5,880,000 on February 14 to $1,588,000 today, data sent to ThinkPol by an industry insider show.

“This is just the tip of the iceberg,” the industry insider who sent ThinkPol the data said. “Many sellers are delisting and relisting to hide price falls and reset days on the market counter.”

The property was previously listed for $5,880,000 on November 30, 2017, but the seller subsequently terminated the listing.

The asking price for a property on 11000 block of Blundell Road in Richmond’s McLennan neighbourhood, originally listed for $4,680,000, has dropped by almost half to $2,380,000, the data show.

The third largest drop we found was in Burnaby’s Brentwood Park neighbourhood, where a property on 4000 block of Alpha Drive has seen its asking price slashed by a third from $2,980,000 to $1,998,000.

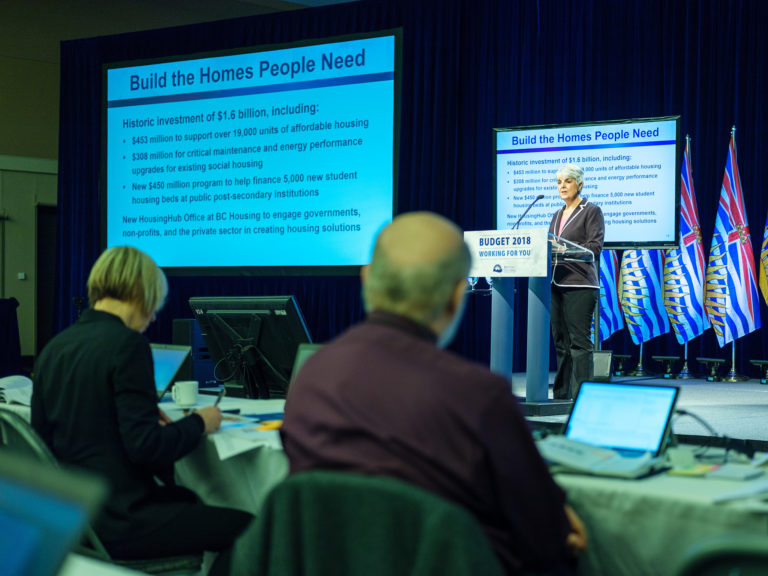

BC Finance Minister Carole James unveiled a budget on Tuesday that contains a thirty point plan to address housing affordability titled “Homes for B.C.”[1]http://bcbudget.gov.bc.ca/2018/default.htm.

The measures include the imposition of a speculation tax and increasing the foreign buyer tax rate from 15% to 20%.

“I hope to see a moderation in the market. We have to make sure that people can live in the community they work in, in the communities their children go to school in,” James told reporters on Wednesday, a day after presenting budget. “I hope you will see more affordable housing.”

The real estate expressed their concern about the impact of the budget measures.

“The budget introduces new taxes, hints at future taxes, and hikes existing taxes on housing,” Real Estate Board of Greater Vancouver president Jill Oudil said. “Taxes don’t make homes more affordable.”

“The new tax measures introduced by the government to “stabilize the housing market” are unlikely to achieve the intended objective,” the BC Real Estate Association stated in a release. “The taxes ignore the major culprit – matching housing supply and demand within a reasonable timeframe. Additional taxes, whether targeted at foreign buyers or speculators, do not reduce the gap between when a housing project starts, and when it is available to purchase.”

The industry insider warned that the industry reaction will go well beyond mere press releases expressing concern.

“The industry is fighting tooth and nail to water down the budget measures,” the whistleblower added. “They’ve hired troll farms to infiltrate social media platforms and push the real estate industry narrative that NDP is ‘punishing’ homeowners.”

The whistleblower is confident that Premier John Horgan’s government will prevail despite industry push back.

“But I don’t believe any amount of narrative control is going to help the industry,” the insider said. “The only reason the bubble kept going for so long was the fact the the BC Liberals turned a blind eye to crime and corruption in our fentanyl-fuelled industry.”

“The criminals know that [Attorney General] David Eby means business,” the whistleblower concluded. “They’re now cutting their losses and fleeing, and the market will correct itself to align with fundamentals.”

| Address | Neighbourhood | Original Price | Current Price | % difference |

|---|---|---|---|---|

| 10XXX SEAWARD COURT | Ironwood | $5,880,000 | $1,588,000 | -73.0 |

| 11XXX BLUNDELL ROAD | McLennan | $4,680,000 | $2,380,000 | -49.2 |

| 4XXX ALPHA DRIVE | Brentwood Park | $2,980,000 | $1,998,000 | -33.0 |

| 7XXX BROADWAY | Montecito | $2,300,000 | $1,699,000 | -26.1 |

| 4XXX RUTLAND ROAD | Caulfeild | $2,899,000 | $2,299,000 | -20.7 |

| 6XXX EAGLERIDGE DRIVE | Eagleridge | $2,988,000 | $2,385,000 | -20.2 |

| 3XXX W 1ST AVENUE | Point Grey | $5,699,000 | $4,588,000 | -19.5 |

| 8XXX PASCO ROAD | Howe Sound | $4,888,000 | $3,989,898 | -18.4 |

| 6XXX MARTYNIUK PLACE | Woodwards | $2,199,000 | $1,798,000 | -18.2 |

| 6XXX HUMPHRIES PLACE | Buckingham Heights | $5,500,000 | $4,500,000 | -18.2 |

[Photo Credit: Province of British Columbia]

References

| 1. | ↑ | http://bcbudget.gov.bc.ca/2018/default.htm |