North Vancouver developer advertising in China scheme to skirt foreign buyer tax

By Amy Chen

A North Vancouver developer is advertising in China a scheme to circumvent Lower Mainland’s 15% foreign buyer tax on real estate through a rent-to-own arrangement.

“Did you know you can buy a house in North Vancouver one of the most desirable cities in the world with only 5% down and if you’re a foreign buyer you can avoid paying the 15% foreign buyers tax?” a video on the advertisement’s[1]http://g.58.com/j-glvancouver/glchushou/29247422868225.html

Archive: http://archive.is/DK9ze landing page[2]http://vancouver-rent-to-own.ca/how-it-works/

http://archive.is/0zd0R asks. “Vancouver rent-to-own is a solid solution brought to you by Apex Western homes an established North Shore builder of 20 years and an accredited Better Business Bureau member why rent own one.”

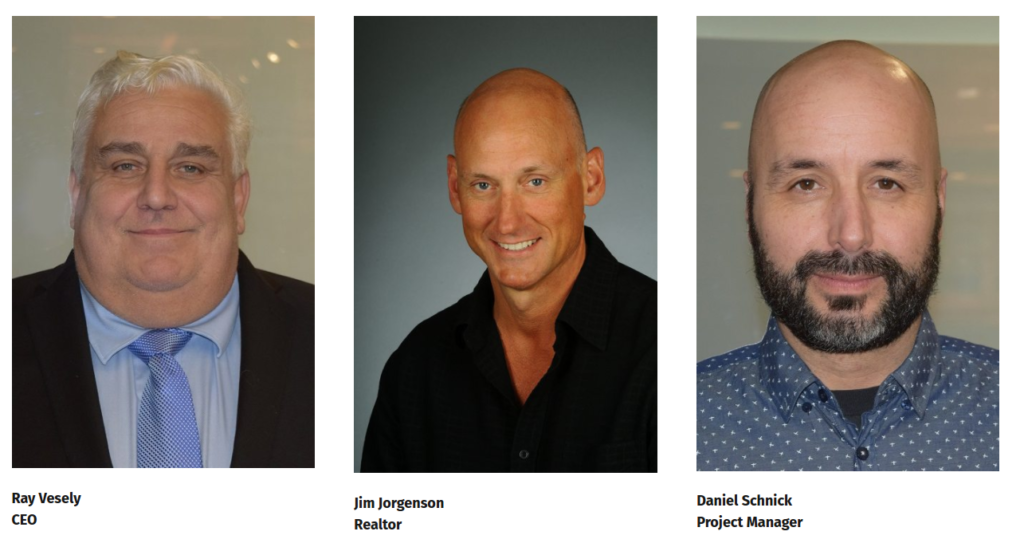

Apex Western Homes CEO Raymond Vesely, Remax realtor Jim Jorgenson, and Apex Project Manager Daniel Schnick are calling themselves the architects of the scheme[3]http://vancouver-rent-to-own.ca/about-us-2/

Archive: http://archive.is/WPMP4.

The listings page shows two active listing and three sold listings, with “rental” running around $10,000 per month[4]http://vancouver-rent-to-own.ca/rent-to-own-listings/

Archive: http://archive.is/EWiny.

“A Rent to Own transaction starts with the contract. The potential buyer pays the seller a one-time 5% non-refundable lease option,” the website explains. “This is a payment that gives the buyer the right or option to buy the home at some point in the future.”

“The buyer and seller set a purchase price for the home in their contract. At some point between 1 and 5 years, the buyer can purchase the home for that price – regardless of what the home is worth,” the website adds. “And in the Lower Mainland, the equity usually goes up over time and the buyer gets to keep the market gains.”

The wording of the Property Transfer Tax Act makes any tax avoidance an offence punishable by a maximum fine of $200,000 and two years in prison.

2.04 (3) If a transaction is an avoidance transaction, the administrator may determine the tax consequences to a transferee in a manner that is reasonable in the circumstances in order to deny a tax benefit that, but for this section, would result, directly or indirectly, from that transaction or from a series of transactions that includes that transaction.

We have reached out to Housing Minister Selina Robinson and Attorney General David Eby to get the government’s position on the legality of this scheme.

We have also contacted Apex Western Homes CEO Raymond Vesely for comment, but we have yet to hear back from him.

ThinkPol needs your help. While other media outlets are content reproducing real estate industry press releases, we carry out painstaking analysis of real estate data, spending hours combing through the data. And the data isn’t free. Each title search alone costs us $12.

References

| 1. | ↑ | http://g.58.com/j-glvancouver/glchushou/29247422868225.html Archive: http://archive.is/DK9ze |

| 2. | ↑ | http://vancouver-rent-to-own.ca/how-it-works/ http://archive.is/0zd0R |

| 3. | ↑ | http://vancouver-rent-to-own.ca/about-us-2/ Archive: http://archive.is/WPMP4 |

| 4. | ↑ | http://vancouver-rent-to-own.ca/rent-to-own-listings/ Archive: http://archive.is/EWiny |