Flipper attempts 100% profit within a year on Coquitlam property

By ThinkPol Staff

Update: Realtor blames typo for 6x attempted flip, claims markup is only 100%

A real estate speculator is attempting to sell for $15 million a Coquitlam, BC property they bought for $7.1 million less than a year ago.

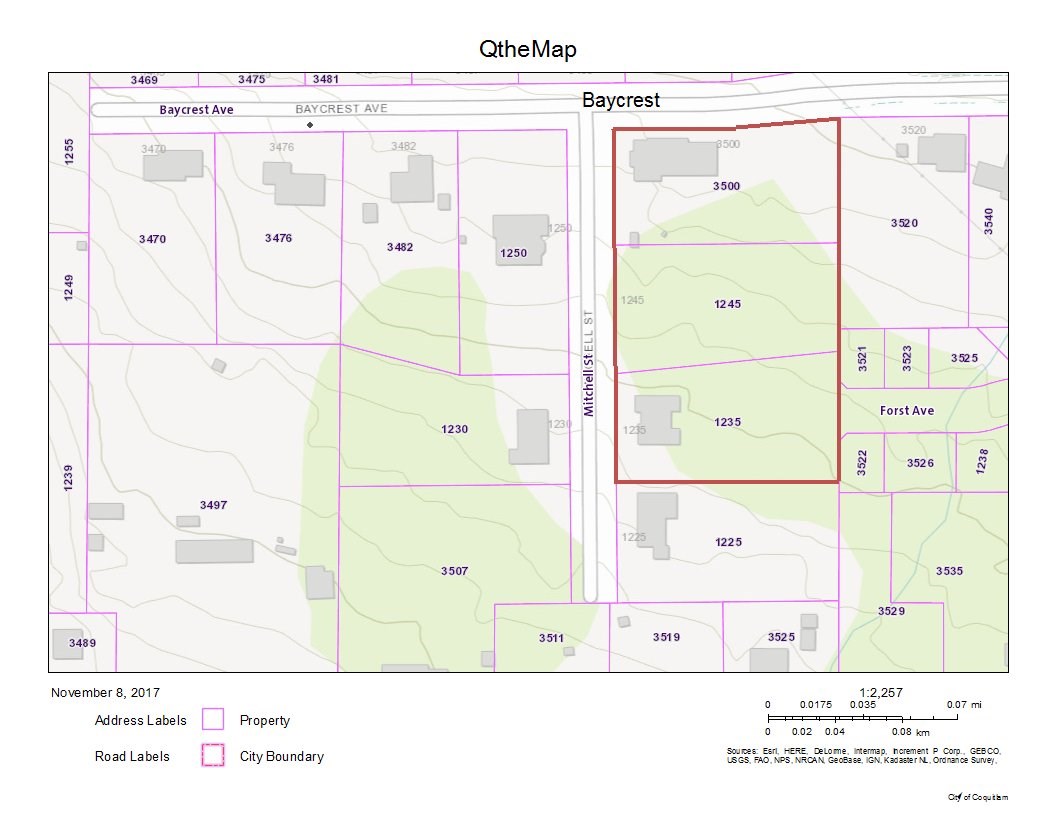

The numbered company 1045353 B.C. Ltd. bought the property at 3500 Baycrest Avenue, Coquitlam in December 2016, according to documentation filed with The Land Title and Survey Authority of BC.

The sixty-year-old five-bedroom three-bathroom property is now listed on the Multiple Listing Service for $15 million[1]https://www.locatehomes.ca/bc-real-estate-listings/coquitlam/mls-R2222621/3500-Baycrest-Avenue-Coquitlam-V3B2W7?id=262244248.

The reason for the astronomical increase in property value seems to be that the City of Coquitlam has rezoned the property and two adjoining lots from RS-2 to RS-7 and RS-8 increasing density seven-fold to allow 21 dwelling units[2]http://www.coquitlam.ca/docs/default-source/council-agenda-documents/regularcouncil_2017_03_06_-_item_14.pdf?sfvrsn=2.

A recent strategy by real estate speculators active in Metro Vancouver has been to buy single-family zoned properties and then get them rezoned as multi-family units to bump up to enjoy mammoth returns on investment.

Researchers have warned that speculating on land value appreciation is a major contributor to housing bubbles.

In Arrested Development: Theory and Evidence of Supply-Side Speculation in the Housing Market[3]http://www.nber.org/papers/w23030 published earlier this year, researchers with US National Bureau of Economic Research identified “mechanisms driving the house price boom by emphasizing speculation among developers on the supply-side of the market.”

“Housing market frictions make land a more attractive speculative investment than housing,” Authors Charles G. Nathanson and Eric Zwick explain. “As a result, undeveloped land both facilitates construction and intensifies the speculation that causes booms and busts in house prices.”

The Government of Ireland introduced a rezoning windfall tax in 2014 to prevent another speculative housing bust as the nation struggled to recover from a recession largely blamed on real estate speculation[4]https://www.irishtimes.com/business/commercial-property/government-to-axe-80-development-land-windfall-tax-1.1963043.

Housing activists in Metro Vancouver have long maintained that housing affordability in the lower mainland needs to be addressed on the demand side.

The housing advocating group Housing Action for Local Taxpayers (HALT) lamented that the NDP government, especially Housing Minister Selina Robinson, is focusing all energies on increasing supply without taking any action to curtail speculation-driven demand.

“Any demand side action, on speculation, tax reforms and addressing financial crime, in real estate will have to come from Ministry of Finance and office of Attorney General,” HALT told ThinkPol in a statement.

ThinkPol needs your help. While other media outlets are content reproducing real estate industry press releases, we carry out painstaking analysis of real estate data, spending hours combing through the data. And the data isn’t free. Each title search alone costs us $12. The Real Estate Board of Greater Vancouver is threatening us with lawsuits for bringing you this data.

References

| 1. | ↑ | https://www.locatehomes.ca/bc-real-estate-listings/coquitlam/mls-R2222621/3500-Baycrest-Avenue-Coquitlam-V3B2W7?id=262244248 |

| 2. | ↑ | http://www.coquitlam.ca/docs/default-source/council-agenda-documents/regularcouncil_2017_03_06_-_item_14.pdf?sfvrsn=2 |

| 3. | ↑ | http://www.nber.org/papers/w23030 |

| 4. | ↑ | https://www.irishtimes.com/business/commercial-property/government-to-axe-80-development-land-windfall-tax-1.1963043 |