BC government investigating North Van developer’s foreign buyer tax avoidance scheme

By Amy Chen

British Columbia’s Ministry of Finance is investigating a foreign buyer tax avoidance scheme run by a North Vancouver developer uncovered by ThinkPol on Sunday, a ministry official confirmed today.

“Our government is committed to making sure our tax system is fair and closing tax loopholes,” a ministry official told ThinkPol in an email. “We are looking into the details of this case, as we would do with any other case that alleges individuals are avoiding paying the additional property transfer tax.”

Apex Western Homes is advertising in China a scheme they cooked up to circumvent Lower Mainland’s 15% foreign buyer tax on real estate through a rent-to-own arrangement.

“Did you know you can buy a house in North Vancouver one of the most desirable cities in the world with only 5% down and if you’re a foreign buyer you can avoid paying the 15% foreign buyers tax?” a video on the advertisement’s[1]http://g.58.com/j-glvancouver/glchushou/29247422868225.html

Archive: http://archive.is/DK9ze landing page[2]http://vancouver-rent-to-own.ca/how-it-works/

http://archive.is/0zd0R asks. “Vancouver rent-to-own is a solid solution brought to you by Apex Western homes an established North Shore builder of 20 years and an accredited Better Business Bureau member why rent own one.”

The Property Transfer Tax Act includes a broad anti-avoidance rule that prevents someone from structuring a transaction to avoid paying the additional property transfer tax, the Ministry warned.

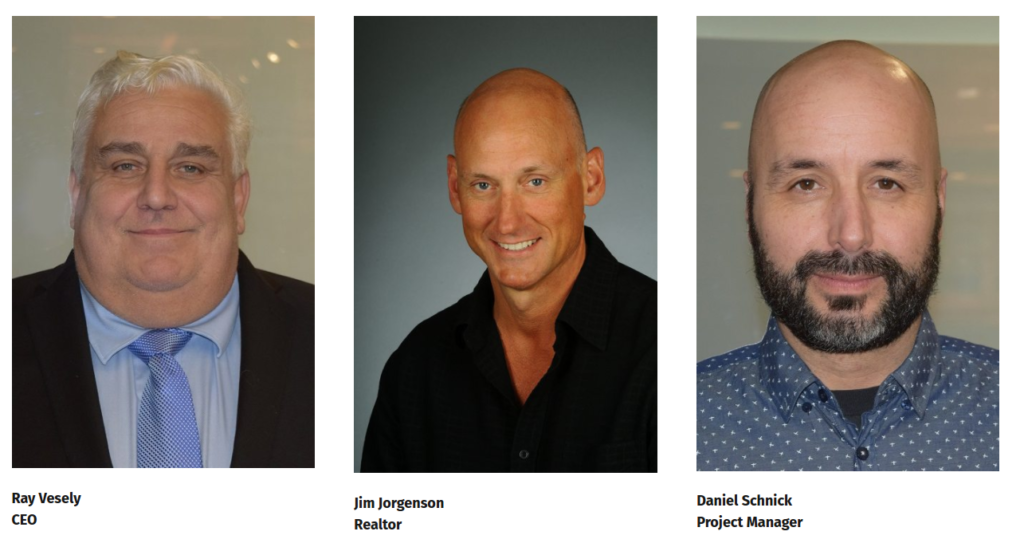

Apex Western Homes CEO Raymond Vesely, Remax realtor Jim Jorgenson, and Apex Project Manager Daniel Schnick, the self described architects of the scheme[3]http://vancouver-rent-to-own.ca/about-us-2/

Archive: http://archive.is/WPMP4, and their clients are looking at potential jail time if charged and convicted.

“In addition to the original tax liability, failing to pay the tax as required can lead to a fine equal to the amount of tax that should have been paid, plus interest, plus an additional fine up to $100,000, or up to two years imprisonment or both, the ministry official pointed out. “Any person who makes false statements in a return or evades compliance with the act can also be subject to the same penalties.”

The listings page shows two active listing and three sold listings, with “rental” running around $10,000 per month[4]http://vancouver-rent-to-own.ca/rent-to-own-listings/

Archive: http://archive.is/EWiny.

“A Rent to Own transaction starts with the contract. The potential buyer pays the seller a one-time 5% non-refundable lease option,” the website explains. “This is a payment that gives the buyer the right or option to buy the home at some point in the future.”

“The buyer and seller set a purchase price for the home in their contract. At some point between 1 and 5 years, the buyer can purchase the home for that price – regardless of what the home is worth,” the website adds. “And in the Lower Mainland, the equity usually goes up over time and the buyer gets to keep the market gains.”

We have contacted Apex Western Homes CEO Raymond Vesely for comment, but we have yet to hear back from him.

ThinkPol needs your help. While other media outlets are content reproducing real estate industry press releases, we carry out painstaking analysis of real estate data, spending hours combing through the data. And the data isn’t free. Each title search alone costs us $12.

References

| 1. | ↑ | http://g.58.com/j-glvancouver/glchushou/29247422868225.html Archive: http://archive.is/DK9ze |

| 2. | ↑ | http://vancouver-rent-to-own.ca/how-it-works/ http://archive.is/0zd0R |

| 3. | ↑ | http://vancouver-rent-to-own.ca/about-us-2/ Archive: http://archive.is/WPMP4 |

| 4. | ↑ | http://vancouver-rent-to-own.ca/rent-to-own-listings/ Archive: http://archive.is/EWiny |